-

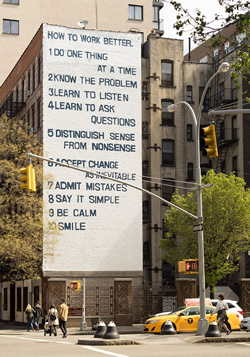

How To Work Better

Seen on a wall in Chester:

1 DO ONE THING AT A TIME

2 KNOW THE PROBLEM

3 LEARN TO LISTEN

4 LEARN TO ASK QUESTIONS

5 DISTINGUISH SENSE FROM NONSENSE

6 ACCEPT CHANGE IS INEVITABLE

7 ADMIT MISTAKES

8 SAY IT SIMPLE

9 BE CALM

10 SMILE

and an extra one from DCAS:

IF YOU ARE MANAGING A VOLUNTARY GROUP REMEMBER TO THANK YOUR STAFF AND PAY THEM A FAIR WAGE!

How to Work Better’s ten-point list of simple statements suggests that “working better” is as much about an approach to everyday life as it is about productivity. The artists Peter Fischli and David Weiss originally appropriated this text from a sign found on a bulletin board in a ceramic factory in Thailand. which was designed to improve worker morale and productivity. Since then, the piece has taken different forms, from postcard to screen print to book cover. Most famously, the artists’ first installed it as a mural on an office building in Zurich in 1991. In 2023 it was reproduced on the side of The Forum Building, Exchange Square in Chester as part of a Contemporary Art exhibition.

-

Finding New Trustees

There are a variety of methods which trustee boards can use to recruit new trustees. Using wider and more inclusive methods of searching for new trustees, by, for example, using trustee brokerage services, can access a wider range of applicants than just from personal recommendation and word of mouth.

Help to find trustees

A number of organisations maintain registers of potential trustees, or offer a trustee brokerage service, matching potential trustees with vacancies on the boards of charities.

The National Council for Voluntary Organisations (NCVO) operates Trustee Bank which allows you to advertise and view trustee vacancies.

Networking with other charities, either from the same local area or offering similar services, can be another way of finding new trustees. This can also be a useful way of sharing information and best practice.How can a charity make its trustee board more diverse?

Practical ways of increasing diversity on the trustee board include:

- making use of more active, open and inclusive methods of recruitment, such as advertising or using trustee brokerage services

- organising trustee board meetings at the most convenient times, or at different times so that people who cannot attend at a particular time are not excluded

- holding trustee board meetings in a venue which is accessible for people with disabilities

- having a policy in place for paying childcare expenses or providing childcare arrangements

- considering people’s needs for translators or sign language interpreters, or for documents available in large print, tape, CD or Braille

- in Wales, taking full account of the bi-lingual society, and ensuring that everyone is able to use either English or Welsh as their language of choice, including receiving written communication in that language

Don’t miss Trustees’ Week 4-8 November 2024

Keep a watch on their website nearer the time

-

Thanks to the Severn Trent Community Fund

Over the last year we have been greatly helped in our work through funding from the Severn Trent Community Fund

Not only has this allowed us to carry out support work, which we have kept free of charge to our service users, but it has also helped us to keep down our accountancy fees during a time of rising prices.

By funding DCAS, the STCF has helped to emphasise the perhaps neglected role of infrastructure that charities play in the sector.

Many thanks to them from all of us a Derby Community Accountancy Service

-

Tell HMRC About A Change To Your Personal Details

You need to tell HM Revenue and Customs (HMRC) if you’ve changed your name or address. How you contact HMRC depends on your situation.

You’ll also need to change your business records if you run a business.

If you submit a Self Assessment tax return, your details will be updated once you’ve reported a name or address change.

Tell HMRC you’ve changed your address.

Tell HMRC your name has changed. You’ll need to sign in. If you do not already have sign in details you’ll be able to create them.

You can also tell HMRC that your name or address has changed using the HMRC app.

Your name will be updated automatically if you change gender.

Tax agents

If you’re a tax agent (for example an accountant), tell HMRC about a change of name or address:

More about the HMRC App for mobile devices can be found here

-

Charitable Objects/Purposes in your Constitution

The Charities Act 2011 defines a charitable purpose, explicitly, as one that falls within 13 descriptions of purposes and is for the public benefit.

How to write your charity’s purposes

Your charity’s purposes should make it clear:

- what outcomes your charity is set up to achieve

- how it will achieve these outcomes

- who will benefit from these outcomes

- where the benefits extend to

Your charity’s purposes and its objects should be the same. The objects should accurately express all of your charity’s purposes.

You usually write your charity’s purpose in the objects clause of its governing document/constitution (the legal document that creates the charity and says how it should be run).

When writing your charity’s purposes, you need to:

- understand that the words you use matter – you can’t say that your charity is set up to do anything that isn’t charitable

- state clearly what your charity’s purpose is – if it’s not clear, the commission can’t be certain that it’s charitable

- be precise – use plain, simple language and avoid vague or ambiguous wording

- explain any terms that may not be generally understood or have more than one meaning

- include all your charity’s purposes, if it has more than one

Terms to avoid

- don’t say “to promote the advancement of” – it’s repetitive and doesn’t add to the meaning of the purpose

- don’t put what your charity will achieve after how it will do it (for example, “making grants as a means to relieve poverty”) – it won’t stop your purpose being charitable but it’s clearer what your charity’s purpose is if you put the ‘what’ before the ‘how’

- don’t use vague or ambiguous wording, such as “to promote good causes”. Not all good causes are charitable causes

- don’t confuse activities with purposes by saying “to further such charitable activities” – it’s your organisation’s purposes that must be charitable. Its activities are what it does to carry out its purposes

- don’t say “to advance [something] in whatever ways that are charitable” or “such of the following purposes as are charitable in law” – this won’t make something charitable that isn’t

- avoid describing your purposes as ‘worthy’, ‘deserving’, ‘benevolent’, ‘philanthropic’, ‘public’, ‘patriotic’, ‘utilitarian’, etc – these sorts of terms can also include things that aren’t charitable

- don’t use the word ‘welfare’ unless it has a specific charitable context like ‘social welfare’ or ‘animal welfare’ – “advancing the welfare of x” on its own isn’t charitable

- don’t use ‘social cohesion’ or ‘community cohesion’ as a charitable purpose – these can be a benefit of carrying out a charitable purpose but the terms are not precise enough to express a charitable purpose itself

Examples of Charitable Objects can be found here

More about Charitable Purposes can be found here

-

Holiday Entitlement – How Much Holiday Someone Gets

Employees have the right to ‘statutory annual leave’ (paid holiday).

This is the case whether they work:

- full time

- part time

- under a zero-hours contract

The number of days’ holiday someone gets depends on:

- how many days or hours they work

- any extra agreements they have with their employer

Employees ‘accrue’ (build up) holiday from the day they start working, including when they’re on:

- a probationary period

- sick leave

- maternity, paternity, adoption or shared parental leave

When to ask for holiday

Employees should ask for their holiday dates as far in advance as possible, This is so the employer can make any arrangements needed.

Employees should ask for holiday at least twice the amount of time beforehand as the amount they want to take off. For example if an employee wants 10 days off they’ll need to ask at least 20 days before.

This is unless their employment contract says they must give more notice.

When to take holiday by

An employer can set a fixed start and end date for when employees should take their holiday entitlement in each year. This is called the ‘leave year’.

If an employer has set a leave year, they should:

- tell employees

- write it in the contract terms or another agreement document

For example, an employer might set the leave year to start and end alongside the financial year – 1 April to 31 March each year.

If an employer has not set a leave year, it begins from the day the employee started working for the organisation.

Employees should take their statutory 5.6 weeks’ holiday entitlement during the leave year.

In some circumstances, employees can carry over their holiday into the next leave year. Find out more about carrying over holiday.

Holiday when leaving a job

During their notice period, an employee might be able to take any holiday they have accrued.

This will depend on whether:

- they can give the right amount of notice to ask for holiday

- their employer lets them take the holiday

Alternatively, the employer might ask the employee to take the holiday before they leave.

How much holiday an employee has depends on how far through the leave year they end the job.

If an employee has any holiday entitlement left when they leave, their employer must add this holiday pay to their final pay. This is sometimes called ‘payment in lieu’ of taking holiday.

An employee might have taken more holiday than their entitlement by the time their job ends. In this situation, the employer can take money from their final pay. This must be agreed beforehand in writing. This is sometimes known as a ‘payback clause’.

Contact the Acas helpline

If you have any questions about holiday entitlement, you can contact the Acas helpline.

-

Holiday Pay and Entitlement

The government has introduced reforms to simplify holiday entitlement and holiday pay calculations in the Working Time Regulations.

Definition of an irregular hour worker and a part-year worker

How a worker is classified will depend on the precise nature of their working arrangements. We would encourage employers to ensure that working patterns are clear in their workers’ contracts.

The government has defined irregular and part-year as the following:

Irregular hours workers

A worker is an irregular hours worker, in relation to a leave year, if the number of paid hours that they will work in each pay period during the term of their contract in that year is, under the terms of their contract, wholly or mostly variable.

Part-year workers

A worker is a part-year worker, in relation to a leave year, if, under the terms of their contract, they are required to work only part of that year and there are periods within that year (during the term of the contract) of at least a week which they are not required to work and for which they are not paid. This includes part-year workers who may have fixed hours.

Holiday entitlement for irregular hours workers and part-year workers

How statutory holiday entitlement is accrued

For workers who are not irregular hours or part-year workers, there is no change in how their statutory holiday entitlement is accrued. The method remains so that in the first year of employment, workers receive one twelfth of the statutory entitlement on the first day of each month. After the first year of employment, a worker gets holiday entitlement based upon their statutory and contractual entitlement. Their entitlement will be based upon the proportion of a week which they are contracted to work. This is known as ‘pro-rating’.

For leave years that begin before 1 April 2024, holiday entitlement will continue to be calculated in the same way for irregular hours and part-year workers. Use the holiday entitlement calculator to work out entitlement.

For leave years beginning on or after 1 April 2024, there is a new accrual method for irregular hour workers and part-year workers in the first year of employment and beyond. Holiday entitlement for these workers will be calculated as 12.07% of actual hours worked in a pay period.

The accrual method to work out entitlement will apply to an agency worker if the agency worker’s arrangements fall within the meanings of both a ‘worker’ (as already defined) and either an ‘irregular hours worker’ or a ‘part-year worker’, as per the new definition in the Working Time Regulations.

An agency worker who is a ‘worker’ but not an ‘irregular hours worker’ or a ‘part-year worker’, will continue to accrue leave at one twelfth of their entitlement at the start of each month during their first year of employment.

Statutory paid holiday entitlement is limited to 28 days. For example, staff working 6 days a week are only entitled to 28 days’ paid holiday.

If an irregular hours/ part-year worker is paid weekly and works 4 hours a week or less, then it may be appropriate for the employer to round up to the next half hour or hour to ensure the worker accrues holiday entitlement.

More details and helpful examples can be found here

-

Thanks to the Severn Trent Community Fund

DCAS send their grateful thanks to the

Severn Trent Community Fund

for their grant funding in support of our work, including training our volunteers in furthering their accountancy skills.

Take a look at the Severn Trent Community Fund’s website on the link below to see if you can apply:

https://www.stwater.co.uk/about-us/severn-trent-community-fund/

-

Charity Fundraising Appeals: Appeal Wording and Record Keeping

Getting your appeal wording right

Charities often run appeals for specific purposes or projects. If you are planning to do that, think carefully about how you word that appeal.

Donations to an appeal for a specific purpose (or purposes) must be used only for that purpose (or purposes).

Include a ‘secondary purpose’

If you are fundraising for a specific purpose, think about including a secondary purpose or purposes in your appeal wording. This says how you will use donations if you raise too much or too little, or the charity cannot use the donations as intended.

Keeping donor and appeal information

Plan how you will keep donor and appeal information before you start your appeal.

Information you should keep:

- donor name, contact details, amount and date received

- how the payment was made, for example, via text or online (if you use an online platform make sure you can contact those donors if necessary)

- letters, emails or other information you collected with the donation

- your appeal literature including any changes made

- any Gift Aid you claim on donations, as you may need to contact HM Revenue and Customs if you return donations

- any conditions attached to a donation (if the donation was not given as an outright gift)

Understand your data protection responsibilities under GDPR.

You will also need this information to follow the required process, detailed in the guidance below, if you are unable to use your appeal donations as intended.

What to do if you are unable to use donations as intended

If you did not include a secondary purpose, you must take specific steps before you can use donations for new purposes. The steps required are set out in our guidance:

-

The Disadvantages of Being A Charity

There are many advantages to being a charity including

- tax breaks;

- a good level of public trust;

- a defined purpose, acting for the public benefit.

BUT charities also have restrictions. For example:

- If you set up a charity you must apply to register it with the commission if it is a charitable incorporated organisation (CIO) or its annual income is more than £5,000, unless it is a specific type of charity that doesn’t have to register.

- Charities must follow charity law, which includes telling the Charity Commission and the public about their work.

- Charities can only have purposes the law recognises as being charitable – they can’t have a mix of charitable and non-charitable purposes.

- Charities must be independent – a charity can work with other organisations but must make independent decisions about how it carries out its charitable purposes.

- Charities must be run by trustees who are normally unpaid volunteers – they can only be paid where it is authorised.

- Charities can’t usually benefit anyone connected with the charity, for example giving work to a trustee’s family member or company, unless it is authorised.

- Charities can’t take part in certain political activities, such as campaigning for a change in government.

- Strict rules apply to trading by charities.

- Registered charities must provide public, up-to-date information about their activities and finances.

- Charities are outward facing – they can’t be set up to benefit the narrow interests of a closed group.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.