-

Eligibility for Employment Allowance

You can claim Employment Allowance if you’re a business or charity (including community amateur sports clubs) paying employers’ Class 1 National Insurance.

You can claim Employment Allowance if you’re a business or charity (including community amateur sports clubs) paying employers’ Class 1 National Insurance.You can also claim if you employ a care or support worker.

If you have more than one employer PAYE reference, you can only claim Employment Allowance against one of them.

If you’re part of a group, only one company or charity in the group can claim the allowance.

You can’t claim if:

- you’re the director and the only employee paid above the Secondary Threshold

- you employ someone for personal, household or domestic work (like a nanny or gardener) – unless they’re a care or support worker

- you’re a public body or business doing more than half your work in the public sector (such as local councils and NHS services) – unless you’re a charity

- you’re a service company working under ‘IR35 rules’ and your only income is the earnings of the intermediary (such as your personal service company, limited company or partnership)

-

Christmas Holidays

The office at Derby Community Accountancy Service will be taking Christmas holidays from Friday 21st December 2018 until the New Year.

The office at Derby Community Accountancy Service will be taking Christmas holidays from Friday 21st December 2018 until the New Year.The office will re-open on Wednesday 2nd January 2019.

May we take this opportunity to wish you all a very Happy and Peaceful Christmas.

-

The SMART way to set your charity’s objectives

All organisations have a goal which they want to ultimately achieve, but to have any sense of achievement, along the way your organisation needs to assess its progress in manageable chunks called objectives.

All organisations have a goal which they want to ultimately achieve, but to have any sense of achievement, along the way your organisation needs to assess its progress in manageable chunks called objectives.Fundamental to any plan is the need to set clear objectives or targets for the organisation against which future service delivery and progress can be monitored.

These objectives should be SMART:Specific – the situation required should be clearly and precisely

specifiedMeasurable – standards should be set against which progress can be

measured

Agreed – all Management Committee members, staff and volunteers

should agree to, and be fully committed to, these

objectives

Realistic – objectives must be realistic i.e. achievable but not too easy

or too challenging

Time-bound – the organisation must specify a time for completionThe following objectives are clear, precise and measurable:

“We will relocate our services to Derby by moving to suitable premises costing no more than £2,500 p.a. and we will complete the move in six months’ time”

“We will increase the number of Service Users by 15% during the next year” -

Ted Cassidy

Ted Cassidy started up CAS here in Derby in 1991, and he worked as Community Accountant until he retired in 1997.

Ted Cassidy started up CAS here in Derby in 1991, and he worked as Community Accountant until he retired in 1997.Since then he has continued his links with DCAS in the background, acting as our Independent Examiner, and continuing to offer great support to the service whenever it has been needed.

Ted has now announced his retirement from this role, and we wish both him and his wife Una a long and happy retirement.

In recognition of the important roles that Ted has held in support of DCAS, supported by Una, the Trustees have announced that they intend to appointed them Honorary Presidents of Derby Community Accountancy Service.

-

About Charitable Purposes

To be a charity your organisation must have charitable purposes only. It cannot have some purposes that are charitable and some that are not (legal requirement)

To be a charity your organisation must have charitable purposes only. It cannot have some purposes that are charitable and some that are not (legal requirement)The Charities Act 2011 defines a charitable purpose, explicitly, as one that falls within 13 descriptions of purposes and is for the public benefit.

There is no automatic presumption that an organisation with a stated aim that falls within one of the descriptions of purposes is charitable. This has to be demonstrated in each case.

Purposes that cannot be charitable purposes

Your organisation’s purpose cannot be a charitable purpose if it does not fall within the descriptions of purposes and is not for the public benefit, including if it is:

- a political purpose

- unlawful or against public policy

- intended to serve a non-charitable purpose

The 13 descriptions and more detailed information can be found here

-

Autumn Budget Statement 2018

National Living Wage & National Minimum Wage:

The government has set a target for the NLW to reach 60% of median earnings by 2020 (subject to sustained economic growth).

The government has set a target for the NLW to reach 60% of median earnings by 2020 (subject to sustained economic growth). Announcements in the Budget include:

Increasing the NLW by 4.9% from £7.83 to £8.21 from April 2019, which will benefit around 2.4 million workers

Accepting recent recommendations by the Low Pay Commission to increase NMW rates from April 2019 as follows:

- Increasing the rate for 21 to 24 year olds by 4.3% from £7.38 to £7.70 per hour

- Increasing the rate for 18 to 20 year olds by 4.2% from £5.90 to £6.15 per hour

- increasing the rate for 16 to 17 year olds by 3.6% from £4.20 to £4.35 per hour

- increasing the rate for apprentices by 5.4% from £3.70 to £3.90 per hour

-

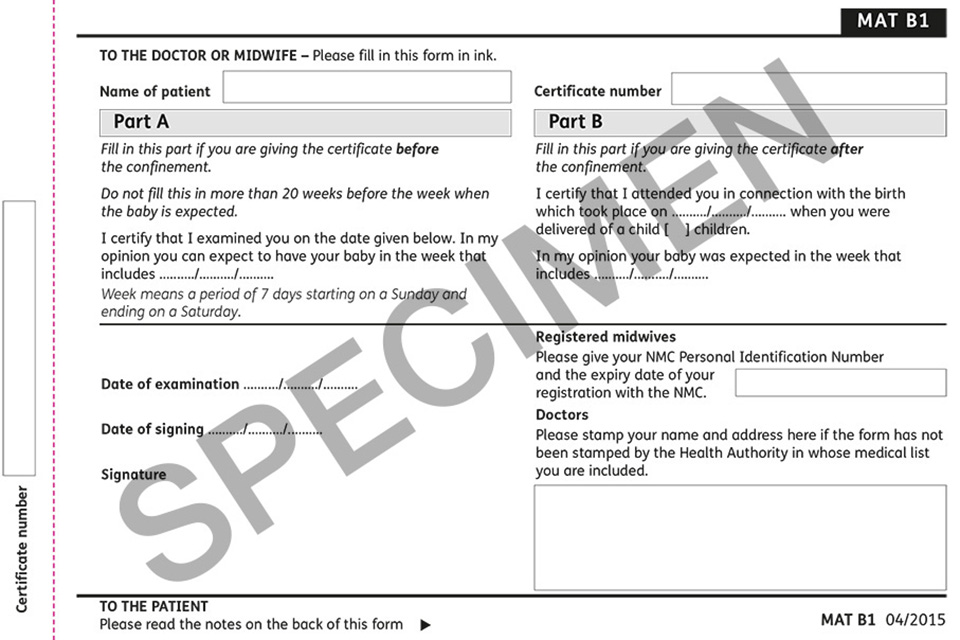

Maternity Certificate MAT B1 Form

In order to claim Statutory Maternity Pay (SMP) from their employer, a woman must provide proof of her pregnancy from a doctor or midwife. This is usually given on form MAT B1

In order to claim Statutory Maternity Pay (SMP) from their employer, a woman must provide proof of her pregnancy from a doctor or midwife. This is usually given on form MAT B1The MAT B1 certificate:

- verifies the pregnancy

- confirms the date of the expected week of confinement (EWC)

- confirms the actual date of birth when completed after confinement

Doctors or registered midwives must issue form MAT B1 free of charge to their pregnant patients for whom they provide clinical care.

-

Charity Fraud Awareness Week 2018

Charity Fraud Awareness Week (22 – 26 October 2018)

Charity Fraud Awareness Week (22 – 26 October 2018)During fraud awareness week the Charity Commission and the Fraud Advisory Panel will be helping the charity sector become more resilient to fraud.

The main aims of the week are to:

- raise awareness of the key risks affecting the sector

- promote and share good counter-fraud practices

- promote honesty and openness about fraud

-

The Andrew Buxton Memorial Award 2018

Staff and Trustees receive the award We were very pleased to pay a visit to this year’s winners of the Andrew Buxton Memorial Award for the best kept set of accounts.

The winners are Bakewell Town and Community Trust, and they made us very welcome at their offices in Bakewell Town Hall. The award was presented by Mrs Janet Buxton.

If you would like details of how your organisation can win next year, please contact us here

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.