You can claim Employment Allowance if you’re a business or charity (including community amateur sports clubs) paying employers’ Class 1 National Insurance.

You can claim Employment Allowance if you’re a business or charity (including community amateur sports clubs) paying employers’ Class 1 National Insurance.

You can also claim if you employ a care or support worker.

If you have more than one employer PAYE reference, you can only claim Employment Allowance against one of them.

If you’re part of a group, only one company or charity in the group can claim the allowance.

You can’t claim if:

- you’re the director and the only employee paid above the Secondary Threshold

- you employ someone for personal, household or domestic work (like a nanny or gardener) – unless they’re a care or support worker

- you’re a public body or business doing more than half your work in the public sector (such as local councils and NHS services) – unless you’re a charity

- you’re a service company working under ‘IR35 rules’ and your only income is the earnings of the intermediary (such as your personal service company, limited company or partnership)

The office at Derby Community Accountancy Service will be taking Christmas holidays from Friday 21st December 2018 until the New Year.

The office at Derby Community Accountancy Service will be taking Christmas holidays from Friday 21st December 2018 until the New Year.

All organisations have a goal which they want to ultimately achieve, but to have any sense of achievement, along the way your organisation needs to assess its progress in manageable chunks called objectives.

All organisations have a goal which they want to ultimately achieve, but to have any sense of achievement, along the way your organisation needs to assess its progress in manageable chunks called objectives.

To be a charity your organisation must have charitable purposes only. It cannot have some purposes that are charitable and some that are not (legal requirement)

To be a charity your organisation must have charitable purposes only. It cannot have some purposes that are charitable and some that are not (legal requirement)

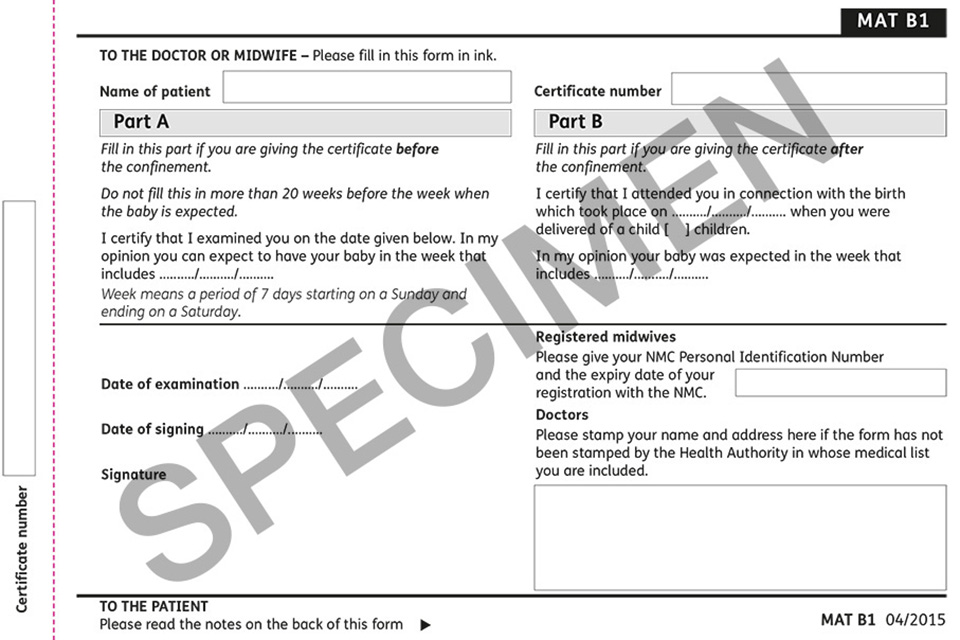

In order to claim Statutory Maternity Pay (SMP) from their employer, a woman must provide proof of her pregnancy from a doctor or midwife. This is usually given on form MAT B1

In order to claim Statutory Maternity Pay (SMP) from their employer, a woman must provide proof of her pregnancy from a doctor or midwife. This is usually given on form MAT B1 Charity Fraud Awareness Week (22 – 26 October 2018)

Charity Fraud Awareness Week (22 – 26 October 2018)