The government reviews minimum wage rates every year and they’re usually updated in April. Check when rate increases must be paid.

From 1 April 2024, workers aged 21 and over will be entitled to the National Living Wage.

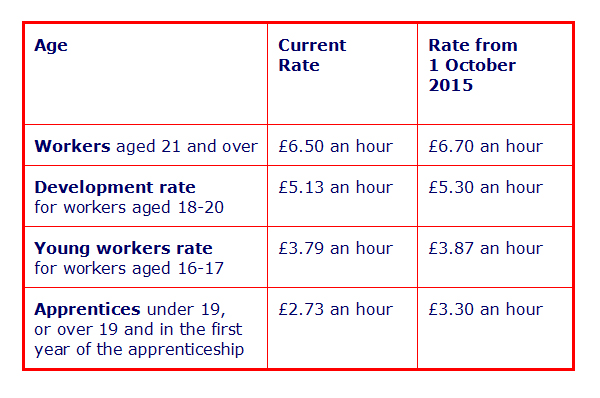

| 21 and over | 18 to 20 | Under 18 | Apprentice | |

|---|---|---|---|---|

| April 2024 | £11.44 | £8.60 | £6.40 | £6.40 |

It’s against the law for an employer to pay less than the National Minimum Wage or National Living Wage.

They also must keep accurate pay records and make them available when requested.

If an employer has not been paying the correct minimum wage, they should resolve the problem as soon as possible.

The employer must also resolve any backdated non-payment of minimum wage. This is even if the employee or worker no longer works for them.

It’s against the law for an employer to pay less than the National Minimum Wage or National Living Wage.

They also must keep accurate pay records and make them available when requested.

If an employer has not been paying the correct minimum wage, they should resolve the problem as soon as possible. The employer must also resolve any backdated non-payment of minimum wage. This is even if the employee or worker no longer works for them.

It’s against the law for an employer to pay less than the National Minimum Wage or National Living Wage.

They also must keep accurate pay records and make them available when requested.

If an employer has not been paying the correct minimum wage, they should resolve the problem as soon as possible.

The employer must also resolve any backdated non-payment of minimum wage. This is even if the employee or worker no longer works for them.

ACAS has more information here