You may notice changes to the fit note you receive from a healthcare professional as a new version of the fit note that was introduced in April 2022. The requirement for the healthcare professional to sign the form in ink has been removed and replaced by the issuer’s name and profession.

There will be a period during which both the new and previous version of the fit notes are legally valid whilst relevant IT systems are updated and stocks of paper fit notes are replaced.

5 things to do if you are given a fit note by an employee

- Check whether your employee’s healthcare professional has assessed that they are not fit for work or may be fit for work.

- Check how long your employee’s fit note applies for, and whether they are expected to be fit for work when their fit note expires.

- If your employee may be fit for work, discuss their fit note with them and see if you can agree any changes to help them come back to work while it lasts.

- If your employee is not fit for work, or if they may be fit for work but you can’t agree any changes, use the fit note as evidence for your sick pay procedures.

- Consider taking a copy of the fit note for your records (your employee should keep the original).

Key things to keep in mind

- Supporting someone with a health condition to come back to work can save you money and minimise disruption

- People can often come back to work before they are 100% fit – in fact work can even help their recovery.

- Often, a few simple changes can help someone with a health condition come back to work earlier.

- Access to Work can help employees with a disability or health condition. This includes paying towards equipment or support.

- If your employee is assessed as may be fit for work, their fit note will help you discuss with them what these changes might be.

- The fit note won’t tell you what changes to make, but will give you advice about how your employee’s health affects what they can do at work.

- If you can’t make any changes to take account of the advice in the fit note, you don’t have to.

- The fit note tells you whether your employee is expected to be fit for work at the end of their fit note.

- If your employee’s healthcare professional thinks they are fit for work, they will not be issued with a fit note.

- Your employee can come back to work at any time, even if this is before their fit note expires. They do not need to go back to their healthcare professional first.

- The fit note belongs to your employee and they should keep the original. You may decide to take a copy for your records.

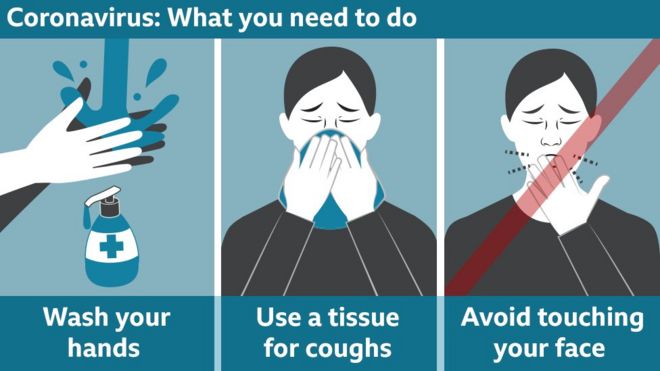

We have been asked for clarification on Sick Pay during the Coronavirus, so here is the official Government advice

We have been asked for clarification on Sick Pay during the Coronavirus, so here is the official Government advice In these very uncertain times, we thought it prudent to direct you to a few documents which are very clear, detailed and helpful for both Employers and Employees regarding Coronavirus (COVID -19)

In these very uncertain times, we thought it prudent to direct you to a few documents which are very clear, detailed and helpful for both Employers and Employees regarding Coronavirus (COVID -19) entitlement is built up (accrued) while an employee is off work sick (no matter how long they’re off).

entitlement is built up (accrued) while an employee is off work sick (no matter how long they’re off).