-

TUPE

TUPE

TUPE stands for the Transfer of Undertakings (Protection of Employment) Regulations

The TUPE rules apply to organisations of all sizes and protect employees’ rights when the organisation or service they work for transfers to a new employer.

TUPE has impacts for the employer who is making the transfer (also known as the outgoing employer or the transferor) and the employer who is taking on the transfer (also known as the incoming employer, the ‘new employer’ or the transferee).

When does TUPE apply?

There are two situations when the TUPE regulations may apply; business transfers and service provision transfers.

In business transfers

The TUPE regulations apply if a business or part of a business moves to a new owner or merges with another business to make a brand new employer.

In service provision transfers

The TUPE regulations apply in the following situations:

- a contractor takes over activities from a client (known as outsourcing).

- a new contractor takes over activities from another contractor (known as re-tendering).

- a client takes over activities from a contractor (known as in sourcing).

ACAS had produced a short introductory video to explain TUPE which you can find here

Terms and conditions under TUPE

When TUPE applies, the employees of the outgoing employer automatically become employees of the incoming employer at the point of transfer. They carry with them their continuous service from the outgoing employer, and should continue to enjoy the same terms and conditions of employment with the incoming employer.

Following a transfer, employers often find they have employees with different terms and conditions working alongside each other and wish to change/harmonise terms and conditions. However, TUPE protects against change/harmonisation for an indefinite period if the sole or principal reason for the change is the transfer. Any such changes will be void.

More detailed information can be found here

-

Eligibility for Statutory Sick Pay

You can get £94.25 per week Statutory Sick Pay (SSP) if you’re too ill to work. It’s paid by your employer for up to 28 weeks.

You can get £94.25 per week Statutory Sick Pay (SSP) if you’re too ill to work. It’s paid by your employer for up to 28 weeks.You need to qualify for SSP and have been off work sick for 4 or more days in a row (including non-working days).

You cannot get less than the statutory amount. You can get more if your company has a sick pay scheme (or ‘occupational scheme’) – check your employment contract.

Eligibility

To qualify for Statutory Sick Pay (SSP) you must:

- be classed as an employee and have done some work for your employer

- have been ill for at least 4 days in a row (including non-working days)

- earn an average of at least £118 per week

- tell your employer you’re sick before their deadline – or within 7 days if they do not have one

Agency workers are entitled to Statutory Sick Pay.

Exceptions

You will not qualify if you:

- have received the maximum amount of SSP (28 weeks)

- are getting Statutory Maternity Pay

You can still qualify if you started your job recently and you have not received 8 weeks’ pay yet. Ask your employer to find out more.

Linked periods of sickness

If you have regular periods of sickness, they may count as ‘linked’. To be linked, the periods must:

- last 4 or more days each

- be 8 weeks or less apart

You’re no longer eligible for SSP if you have a continuous series of linked periods that lasts more than 3 years.

Fit notes (or sick notes)

You only have to give your employer a fit note if you’re off sick for more than 7 days in a row (including non-working days).

You can get a fit note from your GP or hospital doctor. If your employer agrees, a similar document can be provided by a physiotherapist, podiatrist or occupational therapist instead. This is called an Allied Health Professional (AHP) Health and Work Report.

If you’re not eligible or your SSP ends

You may be able to apply for Universal Credit or Employment and Support Allowance (ESA). You can use form SSP1 to support your application.

If your SSP is ending your employer must send you form SSP1 either:

- within 7 days of your SSP ending, if it ends unexpectedly while you’re still sick

- on or before the beginning of the 23rd week, if your SSP is expected to end before your sickness does

If you do not qualify for SSP your employer must send you form SSP1 within 7 days of you going off sick.

-

Disagreements and Disputes in Charities

Why internal disputes are a problem

Why internal disputes are a problemCharity trustees, staff and members can sometimes disagree with each other over decisions about the charity.

A serious disagreement within a charity may cause the charity problems and damage its reputation.

It is your responsibility as trustees to try to resolve a disagreement or dispute. The Charity Commission can only get involved in exceptional circumstances.

How to resolve a dispute yourself

Your charity’s governing document may include a ‘disputes clause’ with procedures for dealing with a dispute. Even if it doesn’t, you should do everything you can to reach an agreement yourselves.

When to get external help

Charity trustees and members need to work together to settle any differences they have. If your trustees can’t reach an agreement and follow the directions in your governing document, you may need to look for some independent external help.

An independent third party will look at both sides and come up with some fresh ways to resolve the dispute.

If the dispute is about the way your charity is run, you could:

- approach the charity’s national or umbrella body, if it has one

- contact an organisation like the Advisory, Conciliation and Arbitration Service “ACAS”

- ask a local church leader or community elder for help, if it is a religious dispute

Mediation

Mediation is a more formal way to settle disputes. It is a private and confidential process in which an independent person meets with both sides, helping them to reach a solution that everyone finds acceptable.

Mediation can be quick and cost-effective. Through mediation, both sides must agree to any solution, so it is more likely to be a lasting agreement.

If your dispute is taken to court, you will be expected to have tried mediation first.

WHEN to involve the COMMISSION

The commission can only get involved in internal disputes when:

- there are no trustees (or correctly appointed trustees) in place, and

- you can show that all attempts to resolve the dispute have failed

When the commission won’t get involved

The commission will not get involved if your dispute is about trustees’ decisions or policies. Trustees are free to make decisions for their charity, so long as they are acting within the law and within the rules of the charity’s governing document.

-

Statutory Maternity Pay and Pay Rises

Employee earnings affected by a pay rise

Employee earnings affected by a pay riseA pay rise must not be withheld because of maternity leave.

You must recalculate the average weekly earnings (AWE) to take account of pay rises awarded, or that would have been awarded had your employee not been on maternity leave.

This applies if the pay rise was effective from anytime between the start of the 8 week relevant period for Statutory Maternity Pay (SMP) and the end of the statutory maternity leave.

If a pay rise is awarded after you’ve calculated your employee’s earnings, and that pay rise is effective from the start date of the relevant period but before the Maternity Pay Period (MPP) ends, you must:

- recalculate the AWE to include the pay rise as though it was effective from the beginning of the relevant period

- pay any extra SMP due

If a pay rise is awarded which, when recalculated, means that earnings are now high enough for your employee to get SMP when they could not before, you must:

- Work out 90% of the AWE.

- Take away the standard rate of SMP.

- Pay the difference for 6 weeks.

If 90% of the AWE is less than the standard rate you might not have to pay your employee anything.

This is because they may have received the balance of SMP due from Jobcentre Plus (or the Jobs and Benefits office in Northern Ireland) as Maternity Allowance (MA).

Not all women are entitled to MA, or the MA may be less than the SMP your employee is now entitled to. You should ask them to get a letter from the Jobcentre Plus (or the Jobs and Benefits office in Northern Ireland) to confirm how much MA was received.

If your employee gives you a letter from the Jobcentre Plus office (or the Jobs and Benefits office in Northern Ireland) showing how much MA was received:

- Work out the total amount of SMP they’re entitled to.

- Take away the MA that was paid.

- Take away any SMP you’ve already paid.

- Pay your employee the difference.

Your employee should still benefit from a pay rise, even if they do not intend to return to work with you after their maternity leave has ended.

If a pay award is made after they have terminated their employment and the pay rise is backdated to when they were working for you, or were on maternity leave with you, they may be entitled to benefit from the pay rise. You must check the terms of their old contract of employment.

If more than one pay rise has been awarded during the period they were on maternity leave you’ll need to make separate calculations for each one.

-

PAYE Form P60 for your employees

If you employ staff, you must give all employees a P60 at the end of each tax year, if they are working for you on 5 April. This must provide this by 31 May, on paper or electronically. You can either:

If you employ staff, you must give all employees a P60 at the end of each tax year, if they are working for you on 5 April. This must provide this by 31 May, on paper or electronically. You can either:- use your payroll software, including HM Revenue and Customs’ (HMRC) Basic PAYE Tools

- order the forms from HMRC if your payroll software can’t produce them

You can’t download blank P45 and P60 forms.

Contact HMRC if you have problems ordering online, your order hasn’t arrived in 7 working days, or to order by telephone 0300 123 1074.

A P60 shows an employee the tax that has been paid on their salary during the tax year (6 April – 5 April). They will get a separate P60 for each of their jobs.

They need this P60 to prove how much tax they have paid on their salary, for example:

- to claim back overpaid tax

- to apply for tax credits

- as proof of their income if they apply for a loan or a mortgage

They can check how much tax they paid last year if they think they might have paid too much (https://www.gov.uk/check-income-tax-last-year)

-

Student Loan Repayments for 2 or more jobs

You’ll only repay your student loan when your income is over the threshold amount for your repayment plan

You’ll only repay your student loan when your income is over the threshold amount for your repayment plan The threshold amounts change on 6 April every year

From 6 April 2020, the repayment threshold for pre-2012 (Plan 1) loans will rise to £19,390.

The repayment threshold for post-2012 (plan 2) loans will rise to £26,575 from 6 April 2020 to 5 April 2021.

Student Loan Repayment if you have 2 or more jobs

If you’re employed, your repayments will be taken out of your salary. The repayments will be from the jobs where you earn over the minimum amount, not your combined income.

Example

You have a Plan 1 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £1,000 a month from one job and £800 a month for the other.

You will not have to make repayments because neither salary is above the £1,577 a month threshold.

Example

You have a Plan 2 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £2,300 a month from one job and £500 a month for the other.

You will only make repayments on the income from the job that pays you £2,300 a month because it’s above the £2,143 threshold.

-

Annual Return Deadline Coming Up!

When to submit your annual return

When to submit your annual returnYou must submit your annual return within 10 months of the end of your financial year

For example, if your financial year end was 31 March 2019, your deadline is 31 January 2020

INcome under £10,000

You only need to report your income and spending

Income between £10,000 and £25,000

You must answer questions about your charity in an annual return.

You do not need to include any other documents

Income over £25,000

You must answer questions about your charity in an annual return.

You will need to get your accounts checked and provide PDF copies of your:

- trustee annual report

- accounts

- independent examiner’s report

You also need a full audit if you have:

- income over £1 million

- gross assets over £3.26 million and income over £250,000

Prepare your annual report and accounts first. You can then upload them when you complete your annual return.

-

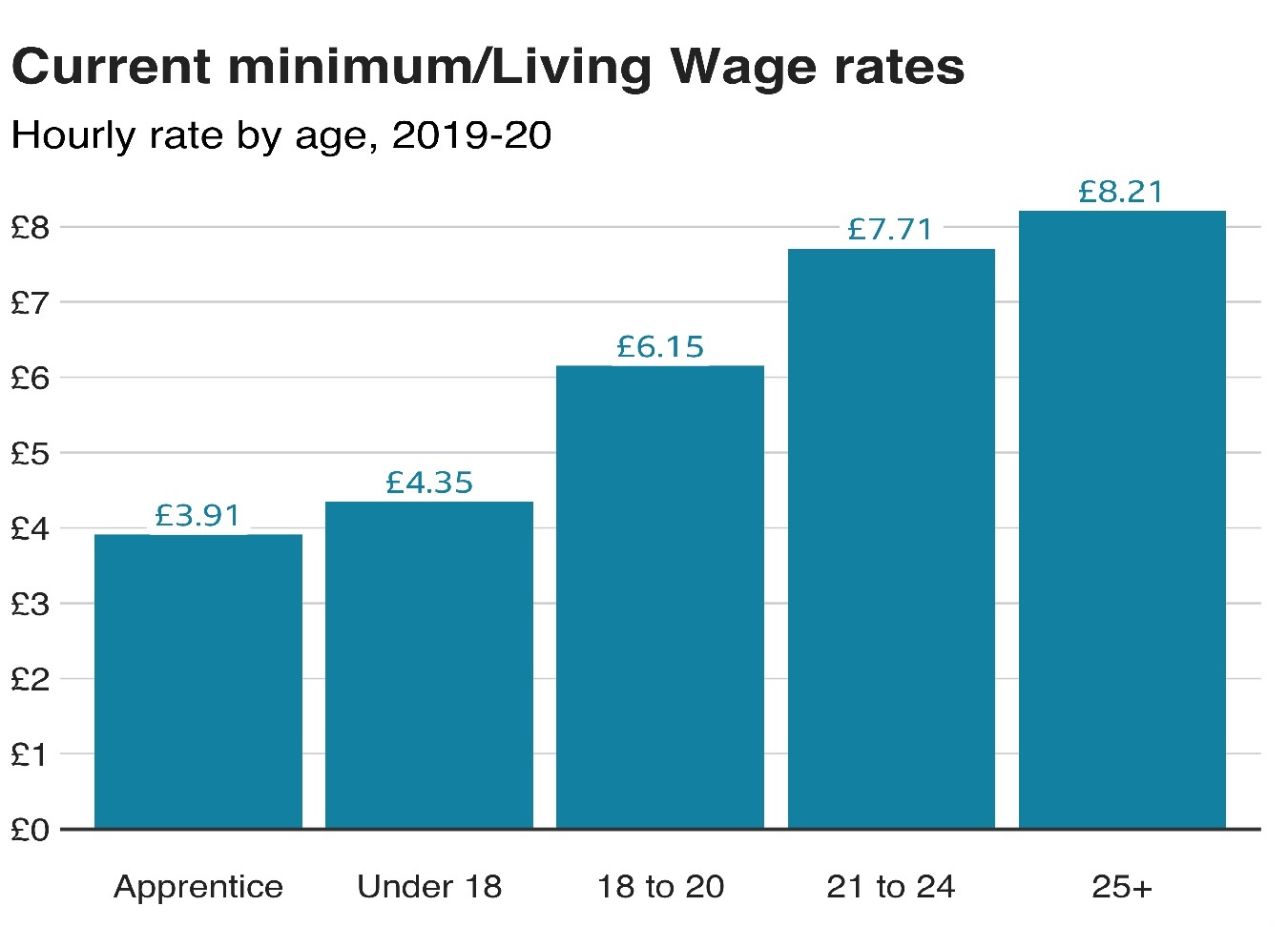

Government announces pay rise for 2.8 million people

The Government has fully accepted the Low Pay Commission’s recommendations after they consulted stakeholders such as unions, businesses and academics, before recommending the National LIving Wage (NLW) and National Minimum Wage (NMW) rates to the Government.

The Government has fully accepted the Low Pay Commission’s recommendations after they consulted stakeholders such as unions, businesses and academics, before recommending the National LIving Wage (NLW) and National Minimum Wage (NMW) rates to the Government.National Living Wage (NLW) is paid to those aged 25 and over

To get the National Minimum Wage (NMW) you must be at least school leaving age, and the pay rates depend on your age and whether or not you are an apprentice

From 1st April 2020, The National Living Wage (for over 25 year olds) will increase 6.2% from £8.21 to £8.72.

The National Minimum Wage will rise across all age groups, including:

- A 6.5% increase from £7.70 to £8.20 for 21-24 year olds

- A 4.9% increase from £6.15 to £6.45 for 18-20 year olds

- A 4.6% increase from £4.35 to £4.55 for Under 18s

- A 6.4% increase from £3.90 to £4.15 for Apprentices, that is all apprentices under age 19 AND any apprentice, regardless of age, in first year of apprenticeship

Apprentices who are aged 19 years and over and not in their first year of apprenticeship are entitled to the National Minimum Wage appropriate to their age group as above

-

Christmas Holidays

Wishing you all a very Happy Christmas from all the staff and trustees at DCAS

The office will close for the Christmas Holidays on Monday 23rd December 2019

The office will reopen on Thursday 2nd January 2020

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.