-

Advice on Whistleblowing from the Charity Commission

Advice on Whistleblowing from the Charity Commission

Advice on Whistleblowing from the Charity CommissionThe Charity Commission is a ‘prescribed person’ under the Public Interest Disclosure Act 1998 (PIDA), which provides the statutory framework for employment protections for charity workers who make a qualifying disclosure (or ‘blow the whistle’) to them about suspected wrongdoing, including crimes and regulatory breaches by their employer.

“Our aim is to make it straightforward for charity workers to bring concerns covered in PIDA to our attention. It is important that they feel able to speak up about a serious wrongdoing they have identified.

We understand how difficult it may have been for them to bring a matter to our attention, and its importance to them. We recognise the value of this information, as workers will have a unique insight into how a charity is operating on a day to day basis.

These disclosures provide us with information that will help us fulfil our regulatory duties.

When opening a case we record the nature of the issue that is raised with us. The most reported issue categories were governance issues, safeguarding, fraud and money laundering.

Whistleblowing disclosures help us detect and prevent concerns within the sector and take steps to put these right. They help create more effective and efficient charities and more generally assist in raising the public’s trust and confidence in charities and the charitable sector.”

You can also report issues to your employer – check your charity’s whistleblowing policy (a Whistleblowing Policy Template can be found here: Whistleblowing-Policy__fraud_site_)

What to report to the Charity Commission

You can report things that have happened, are happening or are likely to happen. Only report issues to them that could seriously harm:

- the people a charity helps

- the charity’s staff or volunteers

- services the charity provides

- the charity’s assets

- the charity’s reputation

-

Independent Examiner – Eligibility and Skills

Charity law requires those charities with a gross income threshold of more than £25,000 to have some form of external scrutiny of their accounts. The trustees may opt for an independent examination if their charity’s income is not more than £1m, or where gross income exceeds £250,000

Charity law requires those charities with a gross income threshold of more than £25,000 to have some form of external scrutiny of their accounts. The trustees may opt for an independent examination if their charity’s income is not more than £1m, or where gross income exceeds £250,000The appointment of an independent examiner is made by the trustees who must reasonably believe that the person selected has the requisite ability and practical experience to carry out a competent examination of the accounts.

The skills required of an examiner will depend on whether accounts are prepared on a receipts and payments basis or an accruals basis, and the size and nature of the charity’s transactions.

All examiners need some familiarity with certain basic principles of fund accounting, the responsibilities of trustees, and the charity’s governing document.

A person with financial awareness and numeracy skills should have the requisite ability to act as an independent examiner for receipts and payments accounts.

For accruals accounts the examiner should have a good understanding of accountancy principles, accounting standards and knowledge of the applicable SORP.

Depending on the complexity of the charity to be examined, prospective examiners may also need to have practical experience relevant to the charity in question which might include:

- an involvement in the financial administration of a charity of a similar nature

- having acted successfully as an independent examiner on previous occasions for similar charities

- relevant practical experience in accountancy or commerce

- a working knowledge of charity accounting

Independent examination of accruals accounts

Having the requisite ability is important to ensure that the examiner undertakes a competent examination. A competent examination is one conducted with reasonable skill and care in accordance with the Directions for independent examination. Trustees who have had the charity’s accounts prepared on an accruals basis should select a person who is a member of one of the accountancy bodies listed in the 2011 Act as amended by the 2015 Order.

The examiner should be satisfied that they have the requisite ability with the necessary skills before undertaking the examination of accounts prepared on the accruals basis. When examining accounts prepared on an accruals basis the examiner should be a member of one of the accountancy bodies listed and the examiner must be a member of a listed body if the charity’s gross income exceeds £250,000.

The listed bodies are:

- Institute of Chartered Accountants in England and Wales

- Institute of Chartered Accountants of Scotland

- Institute of Chartered Accountants in Ireland

- Association of Chartered Certified Accountants

- Association of Authorised Public Accountants

- Association of Accounting Technicians

- Association of International Accountants

- Chartered Institute of Management Accountants

- Institute of Chartered Secretaries and Administrators

- Chartered Institute of Public Finance and Accountancy

- Fellow of the Association of Charity Independent Examiners

- Institute of Financial Accountants

- Certified Public Accountants Association

-

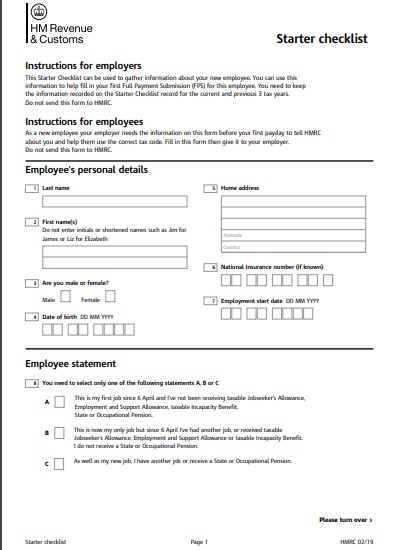

Starting a New Employee

You usually have to pay your employees through PAYE if they earn £118 or more a week (£512 a month or £6,136 a year).You must tell HMRC about your new employee on or before their first pay day.

You usually have to pay your employees through PAYE if they earn £118 or more a week (£512 a month or £6,136 a year).You must tell HMRC about your new employee on or before their first pay day.- Tell HMRC about a new employee.

- Get their personal details and P45 to work out their tax code.

- If you don’t have their P45, use HMRC’s ‘starter checklist’

- Check what to do when you start paying your employee.

You only need a starter checklist from your employee to work out their tax code if they do not have a P45, or if they left their last job before 6 April 2018.

You do not need to operate PAYE on volunteers if they only get expenses that are not subject to tax or National Insurance

Operate PAYE on students in the same way as you do for other employees.

Student loan repayments

You should make student loan deductions if any of the following apply:

- your new employee’s P45 shows that deductions should continue

- your new employee tells you they’re repaying a student loan, for example on a starter checklist

- HM Revenue and Customs (HMRC) sends you form SL1 or form PGL1 and your employee earns over the income threshold for their loan

-

Legal Requirements for Accounting Records

All charities (whether registered with the Charity Commission or not) must prepare accounts and make them available on request. All charities must keep accounting records, and prepare annual accounts which must be made available to the public on request

All charities (whether registered with the Charity Commission or not) must prepare accounts and make them available on request. All charities must keep accounting records, and prepare annual accounts which must be made available to the public on requestCharities with a gross income of more than £25,000 in their financial year are required to have their accounts independently examined or audited

Keeping accounting records

These records – for example cash books, invoices, receipts, Gift Aid records etc must be retained for at least 6 years (or at least 3 years in the case of charitable companies); where Gift Aid payments are received records will need to be maintained for 6 years with details of any substantial donors and to identify ‘tainted charity donations’ in accordance with HMRC guidance

An independent examination is an external review of a charity’s accounts and is carried out by an independent person with the requisite ability and practical experience to carry out a competent examination

An examination involves a review of the accounting records kept by the charity, and a comparison of the accounts presented with those records. This means that all cash books, bank statements, invoices and receipts must also be made available for checking by the independent examiner

-

Closing Down A Charitable Company

The company must first of all be removed from the Companies Register but only if it:

The company must first of all be removed from the Companies Register but only if it:- hasn’t traded or sold off any stock in the last 3 months

- hasn’t changed names in the last 3 months

- isn’t threatened with liquidation

- has no agreements with creditors, eg a Company Voluntary Arrangement (CVA)

A company can apply to the registrar to be struck off the register and dissolved if it’s no longer needed, for example if:

- the directors wish to retire and there is no one to take over the running of the company

- the company is a subsidiary whose name is no longer needed

- the company was originally set up to exploit an idea that turned out not to be feasible

More details can be found here:

Once the company has been removed from the Companies House Register, it can be removed from the Register of Charities.

A charitable company has an automatic right to expend all of its assets on its purposes.

You can tell the Charity Commission that you have wound it up by completing the closure form. This can be done online – more details can be found here:

-

Appointment of Trustees

A charity must follow any rules in their governing document about who appoints new trustees, when, and how, new trustees are appointed and who can be a trustee – the governing document may impose conditions

A charity must follow any rules in their governing document about who appoints new trustees, when, and how, new trustees are appointed and who can be a trustee – the governing document may impose conditionsCo-opted trustees are found most commonly in unincorporated associations or charitable companies where the charity has a membership. Their appointment is under express provisions in the governing document allowing the trustee body to fill vacancies on an ad hoc basis or to supplement the skills of existing trustees.

Trustees may be appointed in a number of different ways – for example:

- they can be nominated by the other trustees or by another organisation, such as a local authority

- they may be elected by the charity’s members

- they may become a trustee by virtue of a post which they occupy, such as a mayor or mayoress of a town, the chief executive of a local health trust or the head master of a school; such trustees are known as ‘ex officio’ trustees

Other than in the case of ex officio trustees, the appointment of a trustee becomes effective only once a prospective trustee has formally agreed to accept the trusteeship. The trusteeship may then begin immediately, or on a specified date.

Following the appointment of a new trustee, trustees must ensure that the Commission is notified of the appointment as soon as possible

-

Payslips and Deductions

Payslips

PayslipsYou must give your employees and ‘workers’ a payslip on or before their payday.

What to include

Payslips must show:

- pay before any deductions (‘gross’ wages)

- deductions like tax and National Insurance

- pay after deductions (‘net’ wages)

- the number of hours worked, if the pay varies depending on time worked

Payslips can also include information like your employee’s National Insurance number and tax code, their rate of pay, and the total amount of pay and deductions so far in the tax year.

Employers must also explain any deductions fixed in amount, for example repayment of a season ticket loan. This can be shown either on a payslip, or in a separate written statement.

Deductions from your employee’s pay

An employer is not allowed to make deductions unless:

- it’s required or allowed by law, for example National Insurance, income tax or student loan repayments

- the employee has agreed in writing

- their contract says you can

- there’s a statutory payment due to a public authority

- they have not worked due to taking part in a strike or industrial action

- there’s been an earlier overpayment of wages or expenses

- it’s a result of a court order

A deduction cannot normally reduce their pay below the National Minimum Wage even if they agree to it, except if the deduction is for:

- tax or National Insurance

- something they’ve done and their contract says they’re liable for it, for example a shortfall in the till if they work in your shop

- repayment of a loan or advance of wages

- repayment of an accidental overpayment of wages

- buying shares or share options in the business

- accommodation provided by you as their employer

- their own use, for example union subscriptions or pension contributions

-

Student Loan and Postgraduate Loan Repayment

Plan and loan types and thresholds

Plan and loan types and thresholdsWith effect from April 2019, the thresholds for making Student Loan deductions are:

- Plan 1 – £18,935 annually (£1577.91 a month or £364.13 a week)

- Plan 2 – £25,725 annually (£2143.75 a month or £494.71 a week)

Repayments for Plan 1 and Plan 2 are calculated at 9% of the income above the threshold.

Postgraduate Loans (PGL) – £21,000 (£1750 a month or £403.84 a week)

Repayments for PGL are calculated at 6% of the income above the threshold.

Starting Student loan and PGL deductions, checking plan and loan type

You should work out the correct figure of employee earnings on which Student Loan and PGL deductions are due. The figure to use is the same gross pay amount that you would use to calculate your employer’s secondary Class 1 National Insurance contributions.

From 6 April 2019 your employee may be liable to repay a PGL at the same time as a Plan 1 or Plan 2 loan. If so, they’ll be due to repay 15% of the amount they earn over the threshold.

Start making Student Loan and PGL deductions from the next available payday using the correct plan and loan type, which you will select on your HMRC submission, if any of the following apply:

- your new employee’s P45 shows deductions should continue – ask your employee to confirm their plan and loan type

- your new employee tells you they’re repaying a Student Loan – ask your employee to confirm their plan and loan type

- your new employee fills in a starter checklist showing they have a Student Loan – the checklist should tell you which plan type and loan type to use, if your employee has both plan type 1 and 2, ask them to check with the Student Loan Company for the correct plan type to take deductions under otherwise, default to plan type 1 until you receive a student loan start notice SL1 that HMRC sends you

- HMRC sends you form SL1 ‘Start Notice’ – this will tell you which plan type to use

- HMRC sends you form PGL1 ‘Start Notice’ – this will tell you they have a PGL

- you receive a Generic Notification Service Student Loan reminder – ask your employee to confirm their plan and loan type

If your employee does not know which plan or loan type they’re on, ask them to check with the Student Loan Company (SLC). If they’re still unable to confirm their plan or loan type, start making deductions using Plan type 1 until you receive further instructions from HMRC – defaulting to Plan 1 is only available for Plan 1 or Plan 2 loans.

-

Claiming Employment Allowance for earlier tax years

You can make a claim for the Employment Allowance up to 4 years after the end of the tax year in which the allowance applies. For example, if you want to make a claim for the allowance for the tax year 2015 to 2016 (that tax year ends on the 5 April 2016), you must make your claim by no later than the 5 April 2020.

You can make a claim for the Employment Allowance up to 4 years after the end of the tax year in which the allowance applies. For example, if you want to make a claim for the allowance for the tax year 2015 to 2016 (that tax year ends on the 5 April 2016), you must make your claim by no later than the 5 April 2020.You will need a separate Employment Payment Summary (EPS) for each year’s claim when claiming for any tax years that have now ended. You don’t need to send previously reported EPS figures, such as statutory payments.

If you send your claim one year after the tax year has ended, your claim will continue into the current tax year, unless you already have a claim for the Employment Allowance in place that year. If you have paid your PAYE up to date, HMRC will set any Employment Allowance award against your future or existing PAYE liabilities, unless you ask them to refund the amount.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.

You must choose a business structure if you’re starting a business that helps people or communities (a ‘social enterprise’).

You must choose a business structure if you’re starting a business that helps people or communities (a ‘social enterprise’).