-

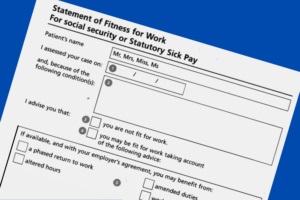

Changes To The Fit Note

You may notice changes to the fit note you receive from a healthcare professional as a new version of the fit note that was introduced in April 2022. The requirement for the healthcare professional to sign the form in ink has been removed and replaced by the issuer’s name and profession.

There will be a period during which both the new and previous version of the fit notes are legally valid whilst relevant IT systems are updated and stocks of paper fit notes are replaced.

5 things to do if you are given a fit note by an employee

- Check whether your employee’s healthcare professional has assessed that they are not fit for work or may be fit for work.

- Check how long your employee’s fit note applies for, and whether they are expected to be fit for work when their fit note expires.

- If your employee may be fit for work, discuss their fit note with them and see if you can agree any changes to help them come back to work while it lasts.

- If your employee is not fit for work, or if they may be fit for work but you can’t agree any changes, use the fit note as evidence for your sick pay procedures.

- Consider taking a copy of the fit note for your records (your employee should keep the original).

Key things to keep in mind

- Supporting someone with a health condition to come back to work can save you money and minimise disruption

- People can often come back to work before they are 100% fit – in fact work can even help their recovery.

- Often, a few simple changes can help someone with a health condition come back to work earlier.

- Access to Work can help employees with a disability or health condition. This includes paying towards equipment or support.

- If your employee is assessed as may be fit for work, their fit note will help you discuss with them what these changes might be.

- The fit note won’t tell you what changes to make, but will give you advice about how your employee’s health affects what they can do at work.

- If you can’t make any changes to take account of the advice in the fit note, you don’t have to.

- The fit note tells you whether your employee is expected to be fit for work at the end of their fit note.

- If your employee’s healthcare professional thinks they are fit for work, they will not be issued with a fit note.

- Your employee can come back to work at any time, even if this is before their fit note expires. They do not need to go back to their healthcare professional first.

- The fit note belongs to your employee and they should keep the original. You may decide to take a copy for your records.

-

How To Raise A Problem At Work Informally

If you have a problem at work you should try raising it informally with your employer first.

You may feel nervous about raising a problem, but employers are often open to resolving problems quickly without going through a formal procedure.

For some very serious problems, an informal chat might not be the best approach. You can raise a formal grievance to your employer.

Have an informal chat with your employer first

You should talk to someone you feel comfortable with where possible first, for example your line manager, another manager or someone in HR.

An informal chat with your manager or employer can range from a quiet word to a more structured meeting.

If you need more support, some organisations have trained members of staff you could speak to, for example:

- fair treatment ambassadors

- mental health first aiders

- health and wellbeing representatives

Your work might also have an employee assistance programme (EAP) you can use.

You can talk to a trade union representative, if you’re a member of a trade union.

Preparing for an informal meeting

If you and your employer or manager set up an informal meeting, it’s a good idea to:

- check the ACAS website for information about your problem and how it might be dealt with

- prepare what you want to say, for example how to explain what you’re unhappy about

- think about what you’d like your employer to do

You can ask someone to go with you, for example:

- someone you work with

- a trade union representative

- an official employed by a trade union

You can ask to bring someone else for extra assistance or support, for example a translator or care worker.

It’s usually up to your employer to agree if you can bring someone else to the meeting. If discrimination law applies your employer might have to allow someone to come with you to help remove any disadvantage.

For example, allowing a support or care worker to attend to provide support could be considered a reasonable adjustment if it would reduce any disadvantage a disabled person might have in raising their problem.

At the meeting

At the meeting you can:

- explain what the problem is and what you think should happen

- show your manager or employer evidence if necessary, for example your payslips and contract if you think your holiday pay was wrong

- take notes

Resolving the problem should be a two-way process. Your manager should allow you to explain the problem. You should also listen to what they have to say.

It might not always be possible to solve the problem in the way you’d like, but you can try to find a solution that works for both of you.

Raising the problem formally

If you cannot reach a solution to the problem, you can raise the issue formally. This is known as ‘raising a grievance’.

If raising a formal grievance does not resolve the problem, you might be able to make a claim to an employment tribunal.

-

Maternity Pay and Leave

Pay

Statutory Maternity Pay (SMP) is paid for up to 39 weeks. You get:

- 90% of your average weekly earnings (before tax) for the first 6 weeks

- £172.48 or 90% of your average weekly earnings (whichever is lower) for the next 33 weeks

SMP is paid in the same way as your wages (for example monthly or weekly). Tax and National Insurance will be deducted.

Use the maternity pay calculator to work out how much you could get.

If you take Shared Parental Leave you’ll get Statutory Shared Parental Pay (ShPP). ShPP is £172.48 a week or 90% of your average weekly earnings, whichever is lower.

Start date

SMP usually starts when you take your maternity leave.

It starts automatically if you’re off work for a pregnancy-related illness in the 4 weeks before the week (Sunday to Saturday) that your baby is due.

Problems and disputes

Ask your employer to explain your SMP if you think it’s not right. If you disagree about the amount or your employer cannot pay (for example because they’re insolvent), contact the Statutory Payment Disputes Team.

-

Don’t forget to prepare your budget!

Budgets are vital to run your charity effectively!!

So what is a budget?

A budget is:

- a financial evaluation of an organisation’s planned services for the coming year

- a forecast of income and expenditure which can be used to monitor financial performance in the year ahead

- a financial plan which may be required by funders

Why budget?

A budget is prepared to:

- ensure that the proposed plan of services to members can be achieved within the finances available

- ensure that best use is made of finances

- establish a method of checking and monitoring financial performance

- report planned and actual performance to the Management Committee

How is the budget prepared?

The following model makes these assumptions:

- The charity has no plans to alter its activities and apply for new grants.

- Any grant funding received is repeat funding and there is complete certainty it will be received.

You should prepare the budget in the following four stages, always making sure that it is approved by a full Management Committee at least one month before the commencement of the financial year.

1. Expenses

The starting point for a budget is the Expense Headings which will usually be fairly obvious:

Example:Wages Who is employed and at what rate? Rent, rates How much and when do we pay? Heat and light How much will it cost to heat the premises? Maintenance Are we responsible for maintenance of the building and are any major repairs necessary? Telephone, etc. How much and when do we pay? Expenses What is the likely cost of Management Committee members and employees’ expenses? Sundries Make a reasonable judgement about these small amounts, e.g. Petty cash items. You now have a list and a forecast value of expenses which you should compare with the previous year’s Actuals to ensure that they are reasonable, and that you have not left anything out.

2. Income

You must now construct the Income side of the budget.

This will comprise Guaranteed Income, i.e. income which has already been agreed by a funder or funders, and non-guaranteed income, i.e. income which you plan to raise.

Again, when you have compiled these figures, you should compare them with the previous year’s Actuals to test if they are reasonable.

3. Comparing Income and Expenditure

Total income and expenditure should now be compared with each other to establish if there is a forecast surplus or deficit of income over expenditure.

It is sound Financial Planning to budget for a surplus of about 5%, i.e. to ensure that Income exceeds Expenditure by about 5%. This should ensure that any unforeseen expenditure can be met.

If there is an adequate surplus then you may proceed to phase the figures, i.e. to analyse the income and expenditure in the month they arise.

If, however, there is a Deficit it will be necessary either to:- seek additional funding

- organise more fund raising

- reduce cost by deferring proposed expenditure

However, BEWARE! It is not good practice to defer necessary expenditure, e.g. Maintenance – ‘buildings don’t get better’.

4. Phasing the budget

Phasing is a most important aspect of constructing a budget. It involves analysing both income and expenditure monthly. This is important because, whilst the total budget for the year may show a surplus, it is quite possible to have sizeable deficits in individual months.

If there is a phasing problem, i.e. if there is deficit in particular months, it may be possible to:- arrange for funders to pay half-yearly in advance instead of quarterly in advance or

- defer expenditure to later in the year

In any event, this problem must be resolved before the budget is submitted for approval.

In due course, when a budget has been constructed showing an adequate surplus and a satisfactory phasing, you should submit the budget to the Management Committee for final approval.

-

Payroll: annual reporting and tasks

Send your final payroll report

Send your final Full Payment Submission (FPS) on or before your employees’ last payday of the tax year (which ends on 5 April).

Put ‘Yes’ in the ‘Final submission for year’ field (if available) in your payroll software.

If you run more than one payroll under the same PAYE scheme reference (for example for employees you pay weekly and monthly), include the end-of-year information in your last report.

You need to send extra forms if you claimed a National Insurance holiday for new employers.

When to send an Employer Payment Summary (EPS)

You should send your final report in an EPS instead of an FPS if any of the following apply:

- you forgot to put ‘Yes’ in the ‘Final submission for year’ field in your last FPS

- your software does not have a ‘Final Submission for year’ field on the FPS

- you did not pay anyone in the final pay period of the tax year

- you sent your final FPS early and you did not pay anyone for one or more full tax months in the last tax year

If you’re late sending your final report

From 20 April you can send an FPS to correct your 2021 to 2022 tax year payroll data by giving the year-to-date figures.

‘Week 53’ payments

If you pay your employees weekly, fortnightly or every 4 weeks, you might need to make a ‘week 53’ payment in your final FPS of the year.

Your payroll software will work out ‘week 53’ payments for you.

In the ‘Tax week number’ field of your FPS, put:

- ‘53’ if you pay your employees weekly

- ‘54’ if you pay them fortnightly

- ‘56’ if you pay them every 4 weeks

HMRC will send a P800 form to any employees who owe tax following a ‘week 53’ payment.

More information can be found here

-

Student and postgraduate loan thresholds from April 2023

The student loan plan and postgraduate loan thresholds and rates from 6 April 2023 are as follows:

- plan 1: £22,015

- plan 2: £27,295

- plan 4: £27,660

- postgraduate loan: £21,000

Deductions for:

- plans 1, 2 and 4 remain at 9% for any earnings above the respective thresholds

- postgraduate loans remain at 6% for any earnings above the respective threshold

Student loan plans, loan types and thresholds guidance will be updated on 6 April 2023 with the new thresholds.

Student and postgraduate loan start notices

If you receive a student loan start notice (SL1) or postgraduate loan start notice (PGL1) from HMRC, it is important that you check and use the correct:

- loan or plan type on the start notice

- start date shown on the notice

This makes sure your employee does not pay any more or less than they have to.

If an employee’s earnings are above the respective student loan and postgraduate loan thresholds, and you do not take deductions, HMRC will send you a generic notification service prompt as a reminder. If deductions still haven’t started, we may contact you directly.

If an employee’s earnings are below the respective student loan and postgraduate loan thresholds, you should:

- update the employee’s payroll record to show they have a student loan and or postgraduate loan

- file the start notice

Deductions should continue until HMRC notifies you to stop.

More information is available on starting student loan and postgraduate loan deductions — checking plan and loan type guidance.

-

Voluntary dissolution of a CIC

A Community Interest Company, CIC, is a special type of limited company which exists to benefit the community rather than private shareholders.

Under section 53 of the Companies (Audit, Investigations and Community Enterprise) Act 2004 a CIC is only allowed to cease being a CIC by dissolution, or by converting to a charity. This means that once a company has become a CIC it can’t convert to an ordinary limited company.

There are a number of different routes to dissolution, each with its own rules and procedures.

Dissolution is fully explained in the Companies House booklet ‘Strike-off, Dissolution and Restoration’.

Apply to voluntarily dissolve a CIC

Complete and send Form DS01 to the Registrar of Companies, with a cheque for £10 made payable to Companies House.

When the form is accepted, a notice will be placed in the London Gazette – or the Edinburgh and Belfast editions as appropriate – giving at least 2 months notice of the intent to remove the company.

If you wish to transfer assets for less than full consideration to an asset locked body that is not already specified in the articles of association, you will need the consent of the Regulator and must complete form CIC53. The information supplied will be used to help the Regulator decide whether or not to object to the striking off of the CIC.

Please note:

- a ‘transfer’ includes every description of disposition, payment, release or distribution, and the creation or extinction of an estate or interest in, or right over, any property.

More detailed information and help can be found here

-

Charity Annual Returns due by 31st January 2023

When to submit your annual return

You must submit your annual return within 10 months of the end of your financial year.

For example, if your financial year end was 31st March 2022, your deadline is 31st January 2023.

If your financial year end was 31st December 2022, your deadline is 31st October 2023.

What charitable companies and unincorporated organisations need to submit

Income under £10,000

You only need to report your income and spending.

Log in to report your income and spending. Select ‘Annual return’ from your available services.

Income between £10,000 and £25,000

You must answer questions about your charity in an annual return.

You do not need to include any other documents.

Income over £25,000

You must answer questions about your charity in an annual return.

You will need to get your accounts checked and provide copies of your:

- trustee annual report

- accounts

- independent examiner’s report

You also need a full audit if you have:

- income over £1 million

- gross assets over £3.26 million and income over £250,000

Prepare your annual report and accounts first. You can then upload them when you complete your annual return.

What type of accounts you need to prepare depends on the type of charity and its finances.

What charitable incorporated organisations (CIOs) need to submit

You must answer questions about your charity in an annual return and include copies of your:

- trustee annual report

- accounts

If your income is over £25,000 you also need to:

- get your accounts checked

- submit a copy of the independent examiner’s report

You also need a full audit if you have:

- income over £1 million

- gross assets over £3.26 million and income over £250,000

Prepare and agree your annual report and accounts first. You can then upload them when you complete your annual return.

What type of accounts you need to prepare depends on your charity’s finances.

-

National Minimum Wage and National Living Wage rates

Current rates

These rates are for the National Living Wage (for those aged 23 and over) and the National Minimum Wage (for those of at least school leaving age). The rates change on 1 April every year.

23 and over 21 to 22 18 to 20 Under 18 Apprentice April 2022 (current rate) £9.50 £9.18 £6.83 £4.81 £4.81 April 2023 £10.42 £10.18 £7.49 £5.28 £5.28 Apprentices

Apprentices are entitled to the apprentice rate if they’re either:

- aged under 19

- aged 19 or over and in the first year of their apprenticeship

More information and examples can be found here

-

DCAS Christmas Holidays 2022

Just to let you all know that the office will be closed from Thursday 22nd December to Tuesday 3rd January 2023.

Many thanks to all of our customers for their continued support.

Happy Christmas from all of us at DCAS!

We look forward to working with you all again in 2023

Enjoy the holiday everyone

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.